unlevered free cash flow yield

LFCF yield measures LFCF against the value of equity while UFCF yield measures UFCF against enterprise value. To break it down free cash flow yield is determined first by using a companys cash flow statement subtracting capital expenditures from all cash flow operations.

Fcf Yield Unlevered Vs Levered Formula And Calculator

1 0 Y A F C F 1 0 -Year average free cash flow O S Outstanding shares O.

. Note that EBIT is an unlevered profit measure since it is above the interest expense line and does not include outflows specific to one capital provider group eg lenders. Essentially this number represents a companys financial status if they were to have no debts. The answer is among other things because a 10 levered FCF yield on the same company implies a massively different enterprise value if that company has 5x of debt versus zero debt.

In the Levered column the year 0 cash flow is -250000. Free Cash Flow to Firm FCFF. Free cash flow yield is really just the companys free cash flow divided by its market value.

Then the free cash flow value is divided by the companys value or market cap. 1 0 Y A F C F O S O W P S P L C A I where. In short unlevered free cash flow is the gross free cash flow generated by a business.

FCF yield is also known as Free Cash Flow per Share. Free cash flow yield is a financial ratio which measures that how much cash flow the company has in case of its liquidation or other obligations by comparing the free cash flow per share with market price per share and indicates the level of cash flow company is going to earn against its market value of the share. Both cash flows illustrate the enterprise value of a particular company but one option levered may be more forthcoming when it comes to the true amount of debt.

Unlevered free cash flow is the cash flow a business has excluding interest payments. SUPERIOR AFTER-TAX FREE CASH FLOW Unlevered After-Tax Free Cash Flow Conversion1 902 MINIMAL NEW HW CENTER CAPEX 72 Cruise lines fund nearly all 63 62 62 maritime health and wellness center buildout costs 51 ASSET-LIGHT MODEL OneSpaWorld does not own 9 any of its maritime HW centers all major maintenance requirements Highly. A company with debt will have a higher unlevered FCF yield than a levered FCF yield.

Why is this you might ask. Unlevered free cash flow is also referred to as UFCF free cash flow to the firm and FFCF. Based on these projections the unleveraged IRR calculation is 989 and the cash-on-cash return averages 2062 but this is skewed higher by the sale of the property.

Like levered free cash flow unlevered free cash flow is net of capital expenditures and working capital needsthe cash needed to maintain and grow the companys asset base in order to generate. Based on whether an unlevered or levered cash flow metric is used the free cash flow yield denotes how much cash flow that the represented investor groups are collectively entitled to. Cash flow per share - one of the various measures of cash flow including operating cash flow free cash flow variants on free cash flow and unlevered and levered free cash flow.

The following table provides additional summary stats. The average unlevered free cash flow yield of the companies is 09 with a standard deviation of 44. The consumer non-cyclicals sector FCF declined from 168 billion in 1Q20 to.

Levered free cash flow includes operational costs while unlevered free cash flow provides a way to calculate without including expenses. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Secondly from a valuation standpoint you need to focus on UNLEVERED free cash flow.

Both metrics will appear on the balance sheet and for many companies the difference between levered and unlevered free cash flow is an important indicator of financial health in and of itself. Price per share - the current trading price of a share of a company or alternatively the total market cap. Free cash flow yield is meant to show investors how much free cash flow a company generates relative to the value of its sources of funds.

This is so impossibly elementary and yet there are literally dozens of. Free cash flow yield is a ratio wherein a FCF metric is the numerator and the total number of shares outstanding is the denominator. If the cash flow metric used as the numerator is unlevered free cash flow the corresponding valuation metric in the denominator is enterprise value TEV.

Microsoft Corporations Unlevered Free Cash Flow Yield of 23 ranks in the 658 percentile for the sector. LFCF yield LFCF Value of equity. Figure 5 shows trailing FCF yield for the consumer non-cyclicals sector soared in 2019 before falling to 25 in 1Q21.

As you can see in the example above and the section highlighted in gold EBIT of 6800 less taxes of 1360 without deducting interest plus depreciation and amortization of 400 less an increase in non-cash working capital of 14000 less capital expenditures of 40400 results in unlevered free cash flow of -48560. Formula from EBIT EBIT FCFF To calculate FCFF starting from earnings before interest and taxes EBIT we begin by adjusting EBIT for taxes.

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Free Cash Flow Yield Explained

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Ufcf Lumovest

Unlevered Free Cash Flow Definition Examples Formula

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Unlevered Free Cash Flow Definition Examples Formula

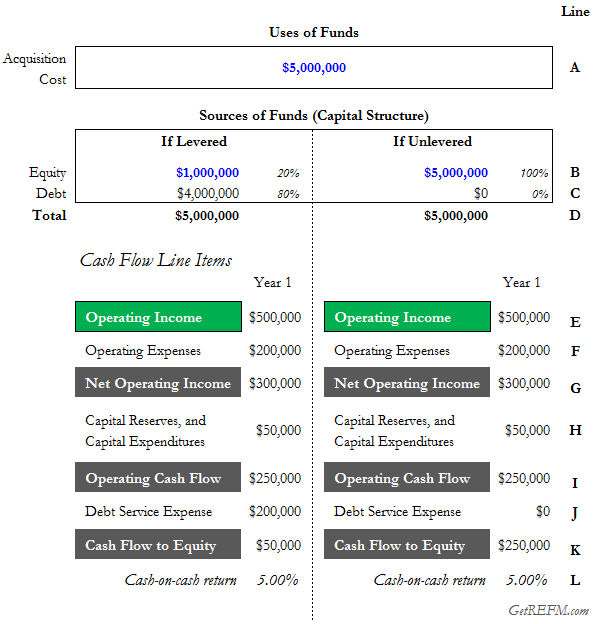

60 Second Knowledge Bite Levered Vs Unlevered Cash On Cash Returns Real Estate Financial Modeling

Consistency Of Free Cash Flow Ratios Lumovest

Levered Vs Unlevered Free Cash Flow Difference Wall Street Oasis

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial